Why Start an IRA?

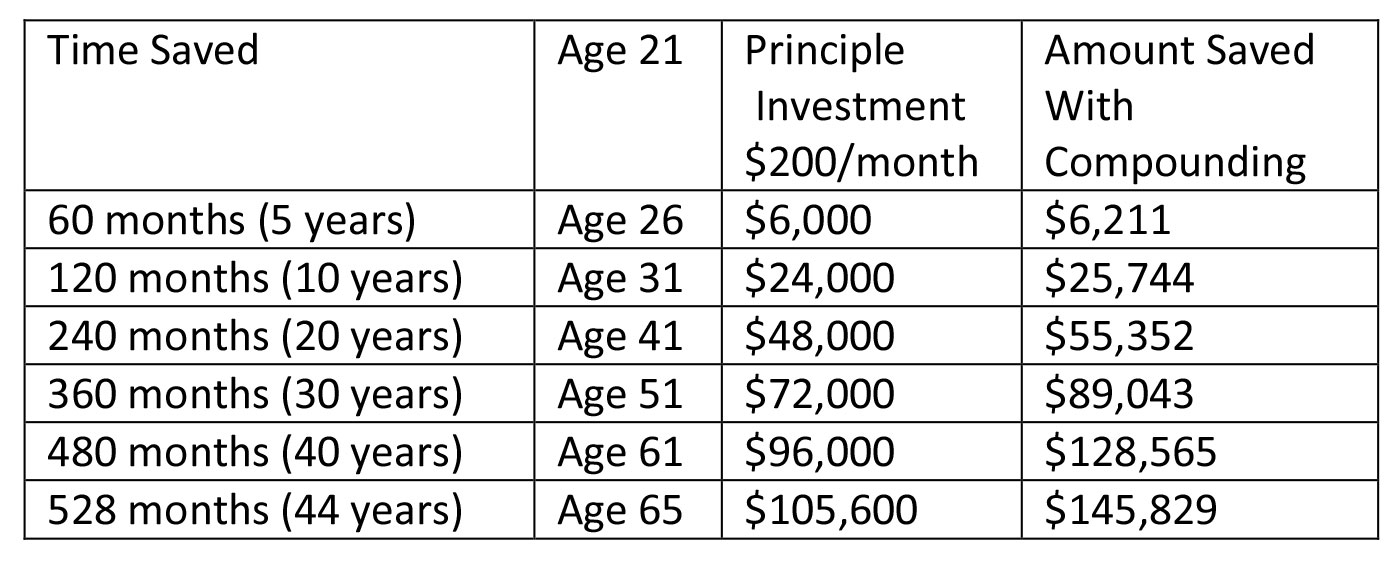

Say you save $100 a pay period, or $200 a month, in an IRA Share Certificate beginning when you’re 21. This account currently pays a 1.40% Annual Dividend Rate for a 60-month term.1 With the effect of compounded dividends over time, allowing principal to grow, by the time you’re 65 years of age, you’d have $145,829 for retirement.2,3 Add to this other investments and anticipated Social Security, and you have a nice start towards retirement!

1 $300 minimum opening deposit for all regular share and IRA certificate accounts

2 Fees could reduce earnings on the account

3 A penalty will be imposed for early withdrawal that could reduce earnings